AI goes in bond market - 价值投资参考

https://simplywall.st/article/ai-companies-hit-the-bond-market?utm_source=braze&utm_medium=email&utm_campaign=Everyone+else&utm_content=Email

以下是原文:

🤖 AI Has Started To Dominate The Bond Market

🤕The bond world experienced a mild panic attack in November as bond issues from AI companies gathered pace. Companies are turning to the debt market to fund their growth rather than relying on cash flows or new share sales. The wave of new bonds kicked off in September and continued through October and November.

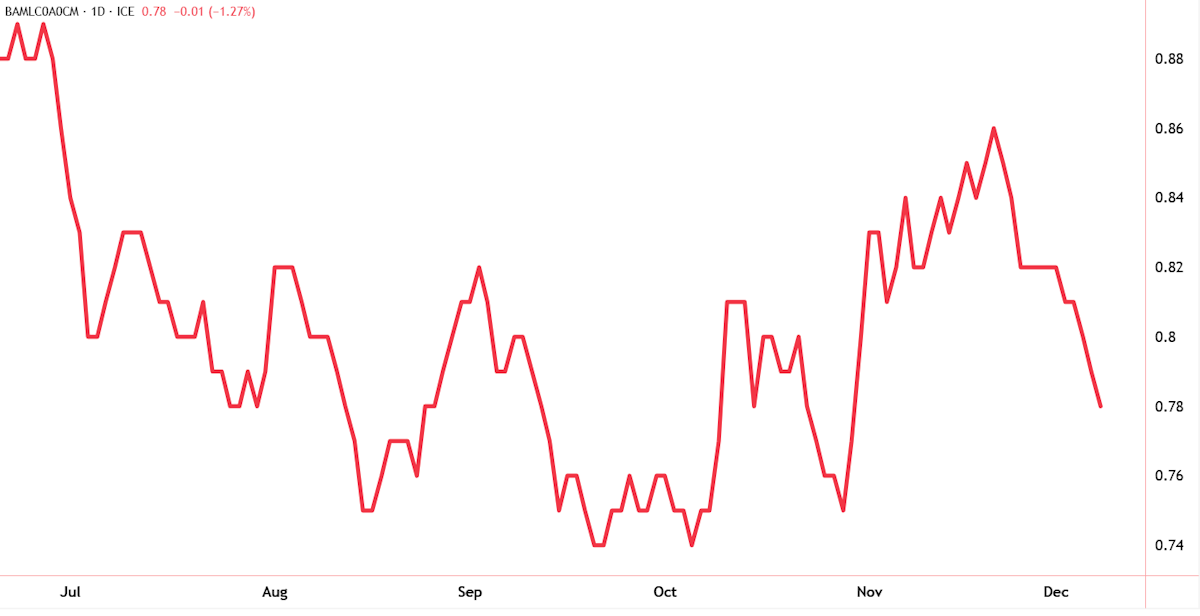

The credit spread between US corporate bonds and US Treasuries spiked to 0.86% in November, but they’ve since narrowed again.

✨ What’s a credit spread? It’s the difference between a bond’s yield, and the yield on US Treasuries.

It represents the premium investors require to compensate them for the additional risk of owning debt that isn’t backed by the government. Wider spreads reflect higher perceived risk.

In the greater scheme of things, this spike was tiny, and anything below 1% is the low end of the range. For context, in 2001 spreads hit 2.45% and in 2009 they touched 6.4%.

😎If anything, the current spread may suggest bond investors are a little too complacent:

- Spreads trading at historically low levels imply very little perceived risk - which is at odds with all the talk of a bubble.

- On the other hand, bond investors are keen to diversify away from US Treasuries, and there aren’t many alternatives.

🤔 What does this mean for AI companies and the Tech Sector?

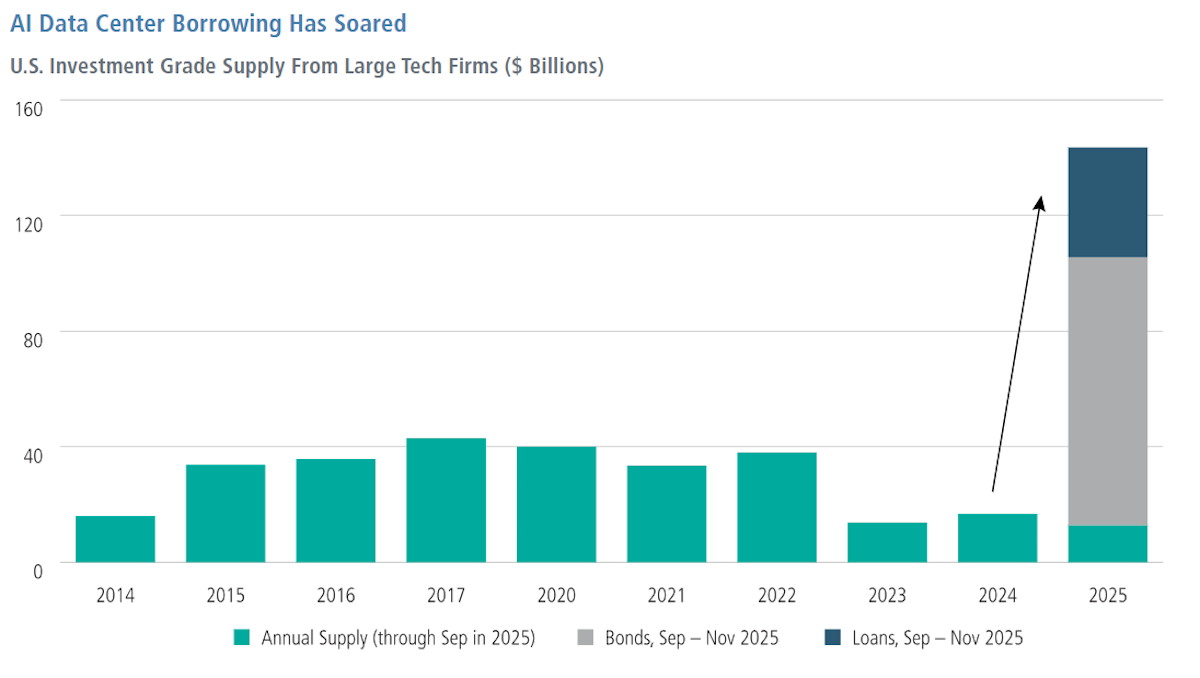

Big tech companies have been swimming in cash for the last 10 years, so they have little reason to borrow. But their CapEx has also soared since the AI boom began. After three years of spending their own cash they’ve decided to add debt to the mix:

To give this more context, consider this:

💻 The tech and communications sectors typically account for around 10% of US corporate bond issuance - way below their 45% combined weight in the S&P 500 index.

🏦 Conversely, the financial sector usually accounts for around 40% of bond issuance, but makes up just 13% of the index.

🛢️ The energy sector is the second biggest bond issuer (15%) but takes up just 2.8% of the index.

So it is unusual to see tech companies using debt like this. However, when we look at how much these companies are expected to spend, the $200 billion projected to be sourced from bond sales is just a fraction of the total. In fact other forms of debt are much larger.

So, why bother with bonds? There are a few reasons:

- 📊 They are diversifying their capital structure.

- 💸 This gives them more liquidity (i.e. cash) for share buybacks and acquisitions.

- 🤑 If the higher for longer rate scenario plays out, ~5% may end up being a bargain.

💰It’s also worth noting that a lot of companies took advantage of near zero rates during the pandemic, and that needs to be refinanced in the next year or two. So companies that want to borrow may want to get ahead of a potential squeeze on liquidity.

⚖️ The Difference Between Bonds From Larger vs. Smaller AI Companies

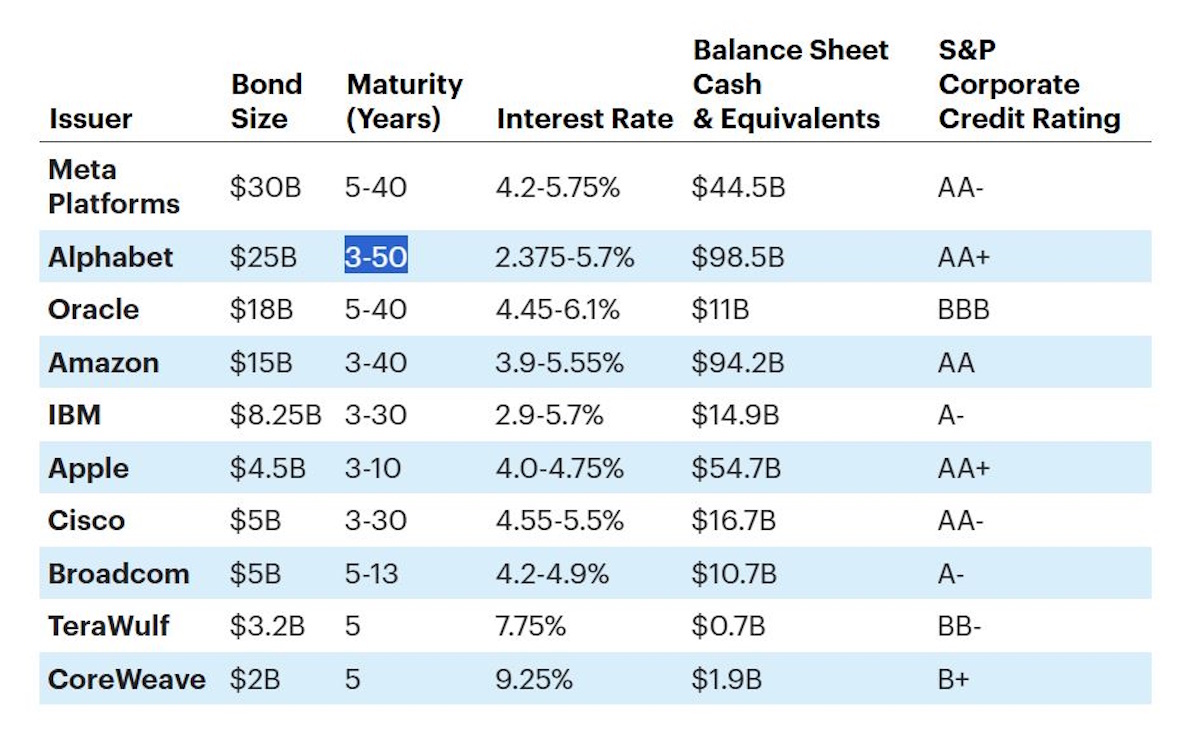

There’s also a very big difference between bonds issued by cash flush hyperscalers (i.e. Alphabet, Apple, etc.) and smaller players. The former are borrowing at around 5% for up to 50 years.

The smaller datacenter operators like TeraWulf and CoreWeave are paying up to 9%, and have to refinance in five years time.

✨ NB: The market might get nervous when supply increases, but the real test typically occurs when it comes to refinancing or repaying debt.

📝 A Note for Equity Investors

Using debt prudently can be great for investors because it allows companies to raise capital without diluting shareholders. But - that’s not the case with convertible bonds, which are once again gaining popularity.

Convertible bonds - which can be converted to equity - lower the interest expense for issuers, but dilute shareholders if they are converted. Investors need to consider the fully diluted share count when projecting EPS.

⚠️ The Risks: When One Sector Dominates Both Debt and Equity Markets

This brings us to the systemic risk angle. When a single sector dominates both stock index performance and corporate bond issuance, it could, potentially, impact the financial system and other sectors.

Here are some reasons why.

🏟️ Crowding Out

Like any market, the bond market is driven by supply and demand. AI companies are now adding new supply to the market, and competing with all the other companies trying to issue debt.

The $200 billion in debt issued by tech companies in 2025 is already about 10% of the US corporate bond market. If it grows, borrowing costs for banks, energy companies and other companies that rely on debt will rise.

In addition, these bond issues add supply to the entire global bond market which includes government, municipal and mortgage bonds.

🚧 Systemic Risk

The financial and banking system is increasingly exposed to AI. Private credit funds, bond funds and banks are lending against the future cash flows of AI companies. If the "AI Bubble" were to burst—the credit market could freeze.

Financial crises are typically triggered by events that drain liquidity from the market. There are lots of parallels to be drawn with the dot-com era, which we covered here.

💾 The "GPU-Backed" Security

GPUs are a hot commodity right now, so it isn’t all that surprising to see them being used as collateral for loans and debt securities. Companies are issuing debt collateralized by clusters of H100 GPUs, which isn’t necessarily a bad idea - provided those GPUs aren't rendered obsolete faster than expected. Of course this also adds a new level of complexity to assessing risk.

Creative structures are also being devised to keep debt off balance sheets. We previously covered these structures, as well as the circular financing deals here. Once again the parallels with previous crises are easy to see.

🏁 The Bottom Line

Whether these risks become real, probably comes down to how far things go. The $200 billion in AI corporate bonds issued this year might be manageable. The ‘danger scenario’ is the one where a whole lot of new, speculative companies jump on the bandwagon, using complex structures to raise money for dubious business models.

- Ironically, this could end up playing into the hands of well financed ‘big tech’ companies that get to pick up the pieces.

💡 The Insight: Why This Matters For Equity Investors

If you are an individual investor you probably don’t invest in corporate bonds - and if you do, it’s more likely to be via an ETF. But you can still use them to inform your decisions about investing in a company’s shares.

Corporate bonds are typically held by institutional funds and hedge funds. The analysts who scrutinize these bonds are extremely thorough.

Where equity analysts are concerned with potential gains, bond analysts are more concerned with potential losses. This makes sense, as bonds offer limited upside, and that upside needs to justify the risk that the company can’t repay the loan.

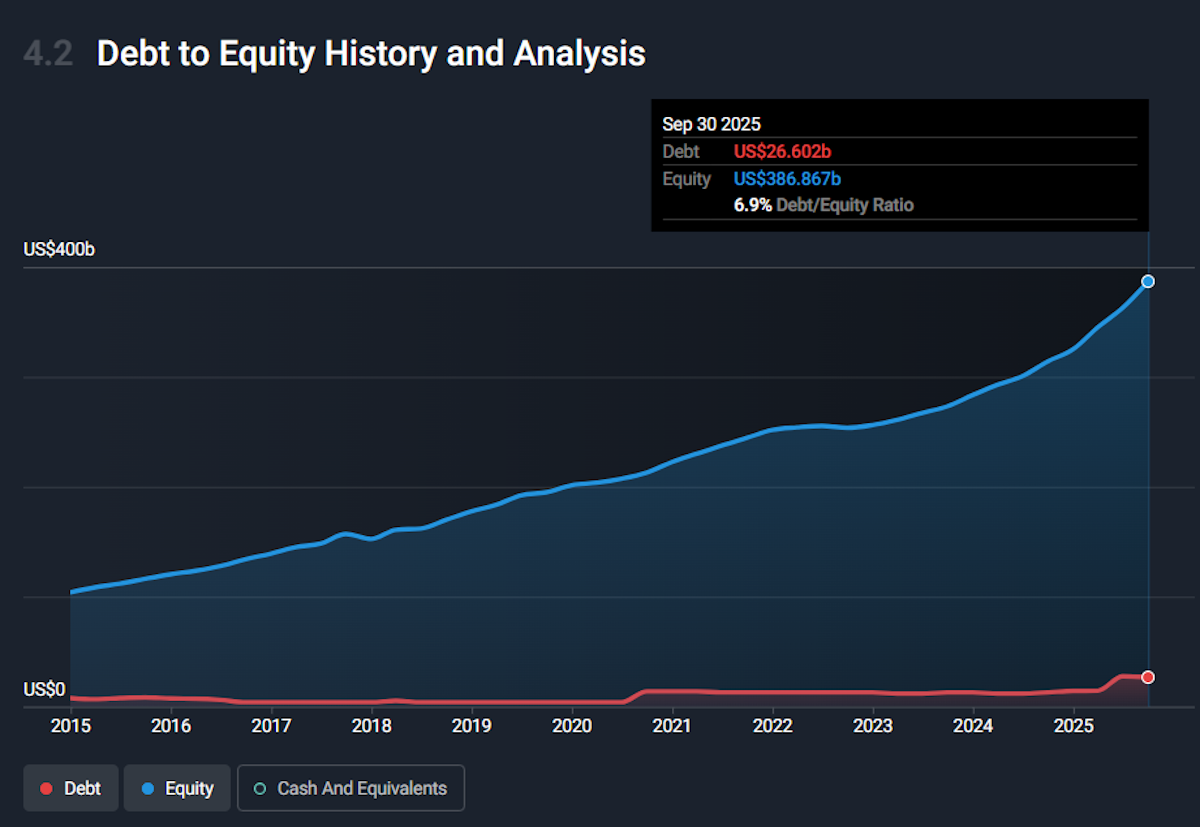

One of the first things to check with any company is the debt to equity ratio.

If it looks like Alphabet’s, the debt is pretty much insignificant:

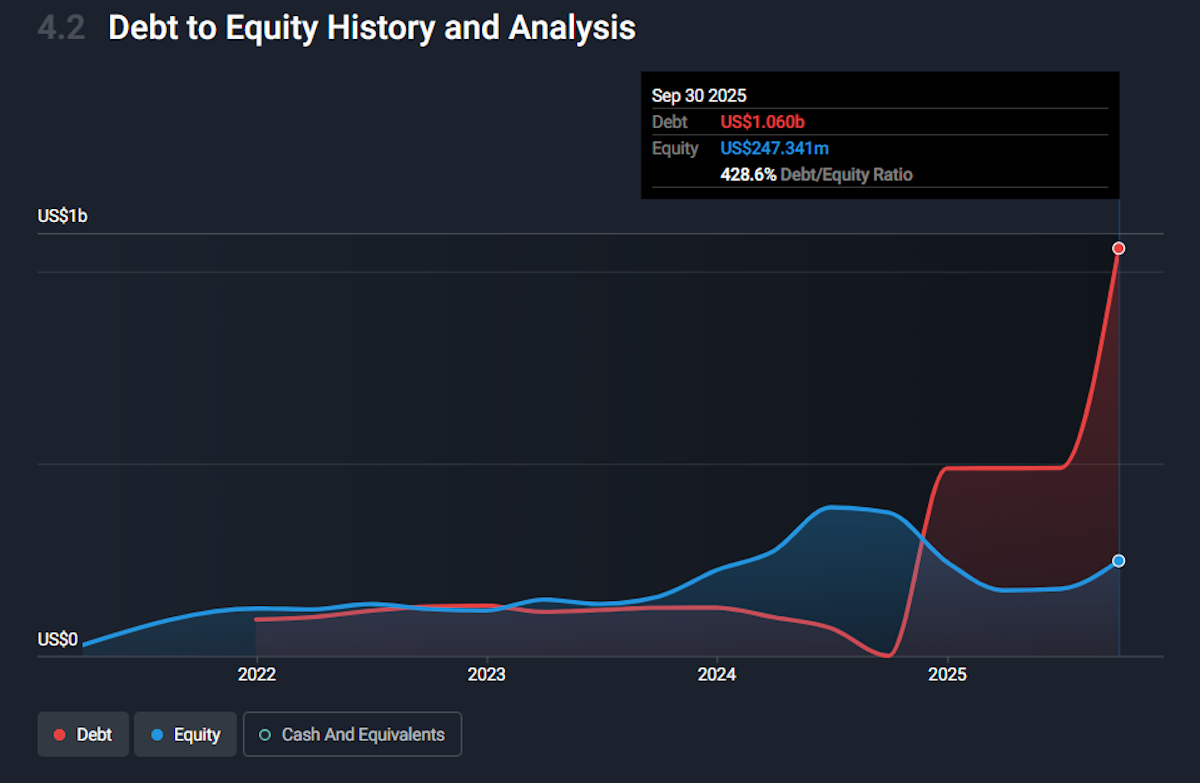

But if it looks like TeraWulf’s, you know debt is a big part of the equation:

If that’s the case, you need to know:

- ⌛ When does the debt need to be refinanced;

- 📉 What is the rate on that debt;

- 🤔 What form the debt takes.

If the debt takes the form of bonds, it’s important to know how bond investors are pricing that debt vs. similar companies and risk free securities (US Treasuries)

Finra (Financial Industry Regulatory Authority) is a wealth of information on corporate bonds. You can find out the coupon and current yield for corporate bonds as well as the Moody’s and Standard & Poor's credit ratings. You can also see how the yield is trending - and compare it to similar yields.

✨ NB: If a company’s stock price is rising, but its bond spreads are widening (yields are going up relative to Treasuries), the bond market is screaming caution. It suggests that while equity traders are hyped on growth, credit analysts are worried about cash flow.

You can also use corporate bond yields to guide your discount rate when valuing a stock.

评论

发表评论